Insights into the future of the wellness industry

The truth is, everybody wants to feel good and well right? But, the idea of wellness goes beyond the traditional health food aisle of the 90’s where branded products were doused in mock brown paper finishes and made to look as unbranded and unappetising as possible. It’s fair to say that in more recent years, the entire industry has undergone a reputation make-over. “Health” has now been rebranded to ”better”, which is a more inclusive way of speaking to both physical and mental nourishment — blurring the lines to create an industry that’s more accessible and inclusive, beyond the hardcore gym junkie and organic vegan health cliche.

This rebirth of the industry has resulted in a plethora of opportunities for big brand owners and entrepreneurial start-ups who are reshaping products and services to suit the changing needs of consumers. And, while the concept of wellbeing has been around since the age of leg warmers and Richard Simmons workout videos (I’m showing my age here), the definition of wellbeing now captures a more holistic perspective.

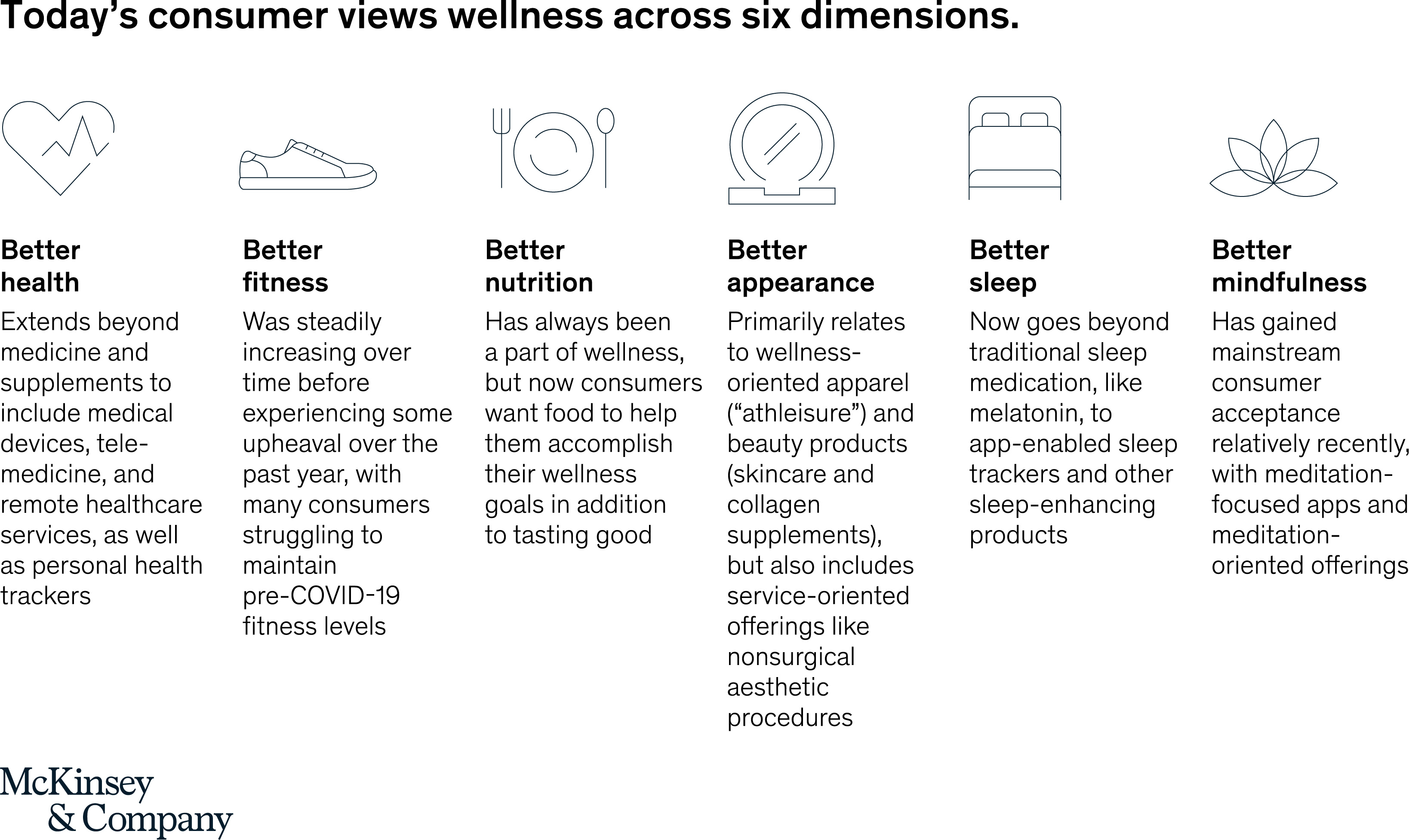

In a recent report published by McKinsey and Company, the findings of their “Future of Wellness” global survey shed light on the significance of the concept of wellness explored through the lens of a mid-pandemic modern world. McKinsey estimates the global wellness market to be worth more than $1.5 trillion, with annual growth of a whopping 5-10 percent! With a rise in consumer interest, a rise in mental health awareness and a significant portion of the workforce now with flexible working arrangements, the wellness industry is a fertile opportunity for existing business and start-ups to create services and products that meet the changing needs of consumers. These are the top 6 consumer wellness trends recently uncovered by McKinsey and Company.

1/ Natural and Clean

The premise of a product being pure, from the grounds and sustainable is at its height of demand right now across categories like skincare, vitamins, subscription foods services, cosmetics, snack foods and alcohol free drinks.

According to a Food Ingredients First Trends Report, Australia is the third fastest-growing plant based food market with not only a proliferation in our grocery aisles, but with the natural and clean reputation permeating mainstream fast food outlets like McDonalds and Hungry Jacks. Cosmetic brands like Sephora’s private label have recently launched clean markup products that are targeting younger audiences, and mainstream children’s confectionary brands like The Natural Confectionary Company have launched more adult offers with vegan and kombucha ranges.

2/ Personalisation please

For may people privacy is still a concern but there is a growing trend towards sacrificing privacy for more tailored offers that are custom built and created to meet an individual’s unique needs. Subscription weight management services like Noom and Everfit are examples of SAAS offerings that require the user to divulge personal information in order to receive what is perceived as a bespoke wellness solution.

3/ Think Digital

McKinsey’s research suggests that the shift to digital is happening at the speed of “decade in days” with the growth coming from e-commerce channels.

Omnichannel strategies are becoming more prevalent with brand owners looking to hedge their bets with both traditional bricks and mortar and digital brand presence. Considering how to keep the consumer engaged through the e-commerce ecosystem is key, and we see this successfully being applied to categories traditionally shopped in store like non-alcoholic wine curation services (Sans Drinks), and farm-to-table regional organic food deliveries like Magic Meadow.

4/ Under the Influencers

We all know how annoying and fake the word of social media influencers can be but in the wellness market this equates to big business. McKinsey’s research outlines that in the Unites States, Europe and Japan, 10 to 15 percent of consumers say they follow social media influencers and have already made a purchase based on an influencer’s recommendation. And, in countries like China and Brazil, that percentage is more like 45-55%, equating to significant consumer influence and trust when executed with authenticity.

5/ The rise of online services

With people’s ability to travel significantly inhabited due to the global pandemic, the rise of online services has exacerbated and brands like the American exercise and media company Peloton have taken full advantage. Now a $1.82 USD billion business, they recently expanded to include subscriptions for their fitness apps, in-person studios and live virtual classes, allowing them to reach consumers that would not have had access to their traditional fitness equipment.

6/ Category lines are blurring

Ice cream brands are now in chocolate blocks, milk brands are collaborating with confectionary brands and non alcoholic gins are on the rise! A majority of consumers interviewed in the McKinsey Wellness Report claimed they did not want a single solution or brand to help them with all facets of wellbeing, suggesting that targeted collaboration or extensions can be a positive way for a brand to stretch itself into new or adjacent categories. When Lululemon acquired Mirror it gave the business a digital offering to compliment its core fitness apparel, and an opportunity to cross-promote within the wellness space.

Glow by Edison is a new thought provoking showcase of global brand initiatives, campaigns, collaborations and innovations designed to stimulate new thinking. If you need help in exploring how you can be purposeful in finding new ways to engage with consumers and winning in the wellness market, get in touch.

Written by Amber Bonney

Founder and Head of Strategy @EdisonAgency